| ID: 1.003 |

| Check field: 01 – Accounts receivable accounting |

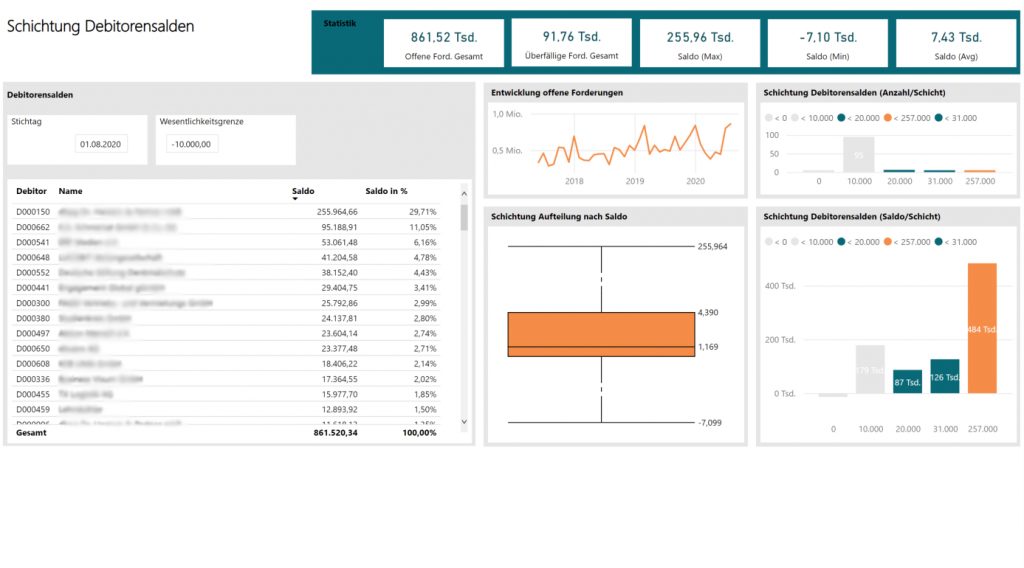

| Name: Stratification of debtor balances |

| Problem: Practice shows that default regularly affects not only individual receivables per debtor, but often the total balance of a debtor. Therefore, the auditor must also keep an eye on the total balances and thus the maximum exposure per debtor as part of his continuous auditing. |

| Description: Within the scope of this audit action / analysis, the balances of all debtors are divided into layers. The parameter to be determined is materiality, i.e. the amount that the balance of a debtor should exceed. Materiality refers to the absolute amount. |

| Combination with audit procedures: Within the framework of functional tests, the auditor must ensure that the implementation of the target system also meets the actual requirements. Consequently, through this audit of the actually existing accounts receivable, audit evidence is to be generated both for the ICS audit and in the context of the individual case audit. The provision of decision-relevant key figures enables the auditor – and of course also the company’s internal user – to carry out plausibility considerations in the sense of analytical audit procedures and in this way also to gain knowledge about the accounts receivable and thus (audit) certainty. |

| Savings potential for the main audit: The stratification of debtor balances, in conjunction with the other oktant audit procedures from this audit field, enables an almost complete audit of the receivables, in particular through the described combination of audit procedures. Even the audit of the correct accrual and deferral and thus indirectly also the revenue recognition is supported by oktant, as the auditor already deals with the company’s internal procedures for time allocation during the year. |

| Supplementary explanation: It is particularly important to examine significant balances at an early stage and to verify their settlement over time. The continuous audit of financial statements proves to be clearly superior to the classical approach by analysing changes in the type, volume and composition of debtors. |